Bernhard: Bangkok Could Overtake Singapore in Thailand’s Gaming Market

Bo Bernhard, vice president of economic development at the University of Nevada, Las Vegas, holds high hopes for Thailand’s emerging gaming industry. He believes that Bangkok alone could surpass Singapore as a top destination for tourism and gross gaming revenue.

Currently, Singapore ranks third globally in gross gaming revenue, following Macau and Las Vegas, thanks to its two integrated resorts, Marina Bay Sands and Resorts World Sentosa. Together, they generated $4.5 billion in 2024 and are projected to reach $5 billion this year, driven by a tourism rebound and new attractions.

Experts predict that a fully developed Thai gaming sector—with integrated resorts in Chiang Mai, Chonburi, Phuket, and Bangkok—could generate between $9.1 billion and $15 billion annually, according to analysts at CSLA.

Bangkok stands out as the prime candidate to lead this growth. With a population of 11.5 million and 32.4 million visitors last year, it is the world’s most-visited city. Bo Bernhard emphasized that Bangkok, supported by world-class infrastructure like its airport, could become one of Asia’s largest gaming hubs with just two resorts.

Bernhard, co-founder of the International Responsible Gaming Alliance, recently met with Thai lawmakers to advocate for the Entertainment Complex Bill. This legislation would legalize large-scale resorts with casinos, despite widespread public concerns about gambling addiction and crime. Supporters argue the bill could increase tourism by 10% annually, create up to 15,000 jobs, attract $2.9 billion in investment, and generate $354 million to $1.1 billion in tax revenue each year.

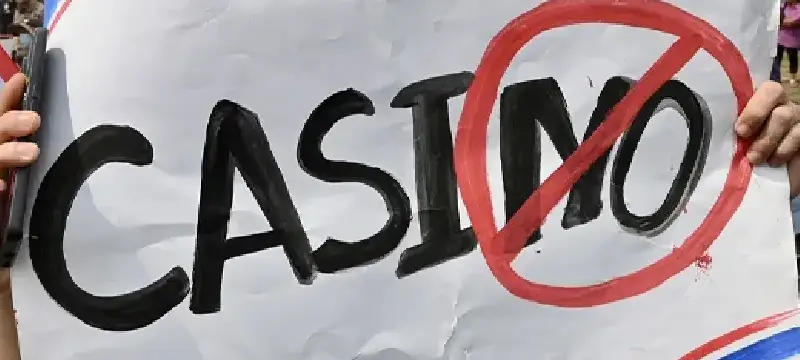

However, the bill’s progress has faced setbacks. After its approval by the cabinet in March, public protests, including demonstrations at Government House, prompted lawmakers to pause the legislation. The Senate formed a panel in April to review the bill, with a report expected by July’s end.

Critics, including opposition MP Rangsiman Rome, warn that casinos could bring crime and corruption similar to what has occurred in neighboring countries like Myanmar, Laos, and Cambodia. Bernhard agrees that strong regulations are crucial to attract reputable international operators such as MGM Resorts and Las Vegas Sands.

He stressed the importance of strict laws, including anti-money laundering and know-your-customer policies, to ensure transparent and legal gaming operations. Enforcement, he said, must be rigorous.

Bernhard views this as a rare opportunity for Thailand amid rising global middle-class populations. With more than half the world’s population now middle class or higher—a figure expected to grow to two-thirds in the next decade—Thailand must act swiftly to remain competitive in attracting tourism dollars.

Proponents believe legal casinos will strengthen the economy and eliminate illegal gambling markets. Yet, as The Diplomat points out, Thailand remains socially conservative, with many viewing gambling as a vice despite its underground prevalence. There are also constitutional concerns over the bill advancing without a public referendum.

In summary, Thailand’s potential gaming industry could be transformative, but it hinges on balancing economic opportunity with strict regulation and public acceptance.